The financial technology (Fintech) industry has been revolutionizing the way we manage and interact with our finances. One area that is rapidly gaining momentum is crypto trading apps. These applications have emerged as powerful tools that offer numerous advantages and are poised to shape the future of Fintech. In this post, we will explore why crypto trading apps are becoming the driving force behind the evolution of the financial industry.

- Accessibility and Inclusivity: Crypto trading apps have significantly democratized access to financial markets. They have eliminated many barriers that traditionally hindered individuals from participating in investing or trading activities. With these apps, anyone with a smartphone and an internet connection can easily enter the world of cryptocurrencies, opening up immense opportunities for global participation in the financial markets.

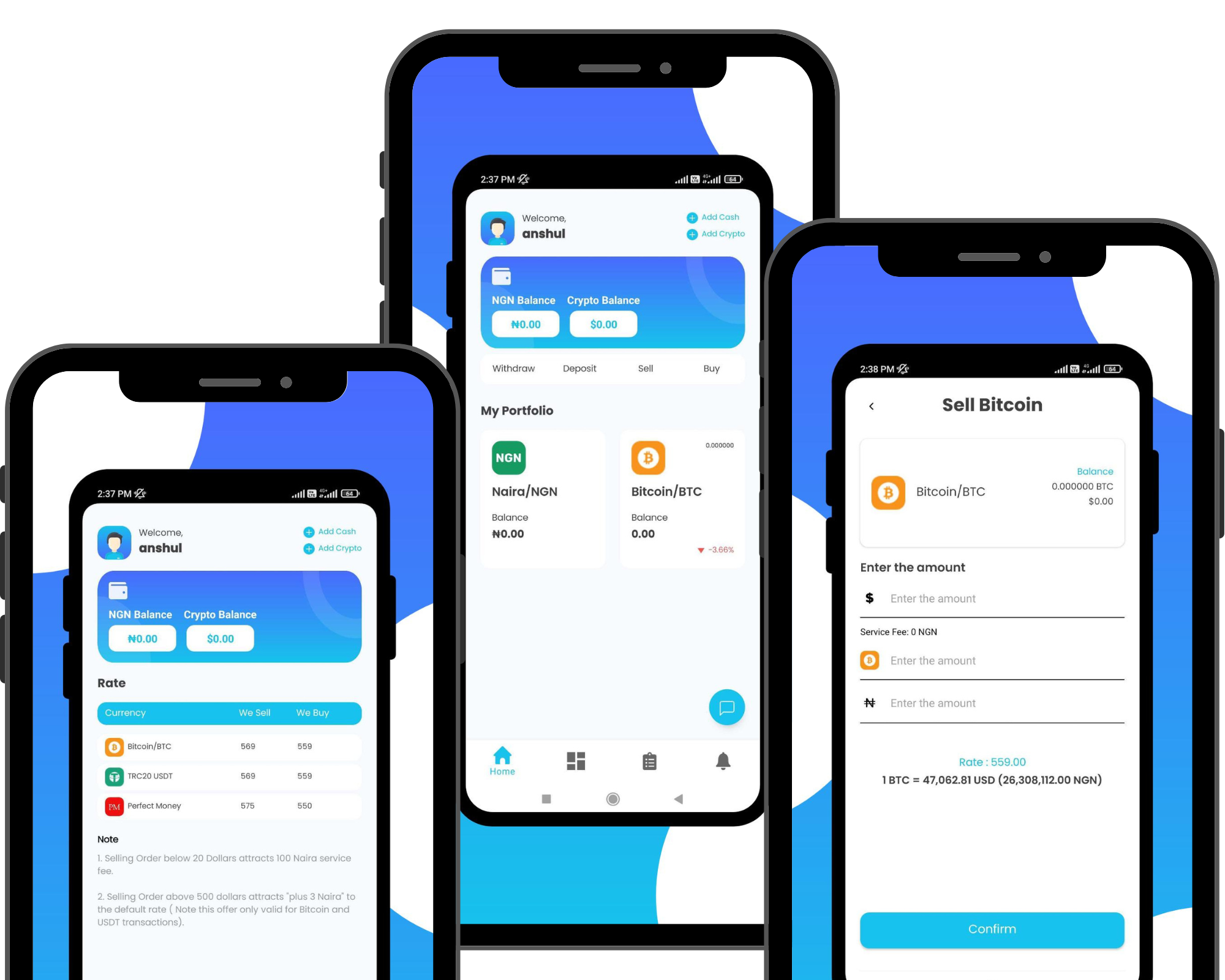

- Seamless User Experience: The user experience provided by crypto trading apps sets them apart from traditional financial platforms. These apps are designed with simplicity, intuitiveness, and user-friendliness in mind. They offer streamlined interfaces, real-time market data, interactive charts, and various tools that assist users in making informed investment decisions. Additionally, many apps provide educational resources to help users understand the intricacies of cryptocurrencies and trading strategies, making it easier for newcomers to enter the market.

- Enhanced Security: Cryptocurrencies are built on blockchain technology, which inherently offers robust security measures. Crypto trading apps leverage this technology to provide secure and encrypted platforms for users to trade and store their digital assets. Features like two-factor authentication, biometric login, and cold storage wallets ensure the safety of users’ funds. As a result, the transparency and immutability of blockchain technology instill trust and confidence among users.

- Global Market Access: Traditional financial markets often have limitations when it comes to cross-border transactions and access for individuals from different countries. Crypto trading apps transcend these barriers by enabling users to trade cryptocurrencies with ease, irrespective of their geographical location. This global accessibility allows for borderless transactions, facilitating international trade and financial inclusion.

- Market Volatility and High Potential Returns: Cryptocurrencies are known for their volatility, and while it can present risks, it also creates opportunities for substantial returns. Crypto trading apps empower users to take advantage of market fluctuations and seize profitable trading opportunities in real-time. The ability to trade 24/7, without the limitations of traditional market hours, enables users to respond promptly to market events and capitalize on price movements.

- Innovation and Future Potential: Crypto trading apps are at the forefront of financial innovation. They are not limited to traditional financial assets and are expanding to include decentralized finance (DeFi), non-fungible tokens (NFTs), and various other emerging digital assets. These apps are catalysts for technological advancements, and as the crypto ecosystem evolves, they will continue to adapt and incorporate new features and functionalities.

Conclusion: Crypto trading apps developed by Top IT companies like Aayan India are undoubtedly revolutionizing the Fintech landscape. Their accessibility, user-centric design, security, global market access, potential for high returns, and ongoing innovation make them a key player in shaping the future of finance. As cryptocurrencies gain wider acceptance and adoption, crypto trading apps will play an instrumental role in empowering individuals to take control of their finances and participate in the digital economy. Embracing these apps can unlock immense potential for both experienced traders and newcomers alike, enabling them to be part of the financial revolution that lies ahead.